Edgewater Research: Distribution Supply Chain Digest - January 2024

4Q23 Best Case Inline & Sub-seasonal; 1Q24 Off to a Weaker Start, Competitive Pressures Growing Among Distributors

4Q23 Best Case Inline & Sub-seasonal; 1Q24 Off to a Weaker Start, Competitive Pressures Growing Among Distributors

Note: This is not the full Insights report, if you are interested in receiving the full report, please click here to learn more.

Key Points:

- 4Q global POS at best seen in-line, with downside in Europe on year-end shutdowns and mixed demand in APAC/Americas.

- 1Q outlook seen sub-seasonal (down LSD-MSD) on extended shutdowns (CNY/Europe) and continued inventory digestion globally.

- APAC feedback down ticking vs. Oct/Nov on end-demand uncertainty, lack of China bookings recovery, and incremental headwinds from high inventory at brokers.

- Inventory progress noted as limited in semis, better in IP&E. Semi digestion expectations seen partially pushed to 3Q.

- Competitive dynamics seen up ticking in volume/catalog distribution driving some discounting and incremental margin pressure. Competitive dynamics more pronounced in APAC, but also in IP&E with private distis defending share vs. Arrow/Avnet.

- Suppliers seen raising pricing support to distis, particularly in APAC. Increased rebates seen driving some inventory write-downs.

- Analog Devices noted establishing a strategic initiative to drive more 2024 sales direct. TI seen continuing to push to more direct in 2024.

Top 3 Channel Comments:

- The CY24 outlook in distribution in China is not good. We were expecting to see more signs of recovery by now but that has not happened. We are cautiously projecting a flat year with 1H down Y/Y offset by modest growth in 2H on new programs.

- Customers are telling our partners like Arrow that they are placing fewer orders because they are buying at lower prices from brokers.

- The inventory digestion is just slower, taking much longer than we were hoping. We are starting to think that the expectation that digestion is over by the end of 1H may prove lofty. The problem is there is more inventory headwind at customers than we estimated and secondly the demand recovery in China is nowhere to be found.

Conclusion:

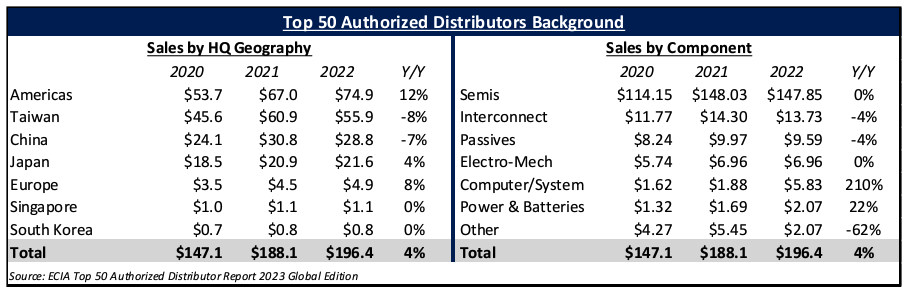

Distribution fundamentals remain challenged with limited signs of order recovery and soft POS particularly in semis. In IP&E feedback is more mixed with pockets of green shoots in certain markets/geographies but signs of improvement in Industrials remain limited. Overall, distributor inventories continue to be noted as stubbornly high and though the supply chain continues to hold onto the 2H24 recovery expectations, concerns regarding the duration of the digestion and the shape of the recovery in distribution remain, translation into a muted 2024 outlook of flat to low single digit growth in POS.

Back

Back