Multi-Sourcing Strategies For Medical Electronics Products

98%: That is the estimated growth percentage over 10 years of the medical electronics market from a value of $172 billion in 2024 to an estimated value of $340 billion by 2034.

In the high-stakes world of medical electronics, where precision, reliability, and compliance are non-negotiable, supply chain resilience is no longer just a competitive edge, it has become a regulatory and operational imperative. The ability to withstand disruptions, adapt to market volatility, and maintain uninterrupted production is essential for companies operating in this space.

One of the most effective strategies to achieve this resilience is multi-sourcing: the deliberate qualification and use of multiple suppliers for critical components. This approach has evolved from a best practice into a foundational element of modern supply chain design. It not only mitigates risk but also enhances flexibility, supports regulatory compliance, and ensures that patient safety and product quality are never compromised.

Multi-sourcing is not a new concept, but its importance has grown significantly in recent years. Global events such as the COVID-19 pandemic, semiconductor shortages, and geopolitical tensions have exposed the vulnerabilities of single-source dependencies. In response, engineering and procurement teams are rethinking their sourcing strategies, placing greater emphasis on supplier diversification, geographic spread, and long-term risk mitigation.

This article delves into how organizations can implement effective multi-sourcing strategies, building on principles discussed in earlier explorations of smart sourcing and component selection. It offers practical insights for teams looking to strengthen their supply chains without sacrificing efficiency or compliance.

Why Multi-Sourcing Matters

Medical electronics products are held to some of the highest standards in the manufacturing world. These devices often support or sustain life, which means that any failure, whether due to a faulty component or a supply chain disruption, can have grave consequences. As such, the stakes are incredibly high. A single-source dependency, where a critical component is only available from one supplier, introduces a significant point of failure. If that supplier experiences delays, quality issues, or ceases production, the entire product line may be at risk. This can lead to missed delivery deadlines, increased costs, regulatory scrutiny, and in the worst cases, compromised patient safety.

Relying on a sole supplier for key components exposes manufacturers to a wide range of risks. These include geopolitical instability, natural disasters, trade restrictions, and component obsolescence. Multi-sourcing addresses these risks head-on by ensuring that alternative sources are available and qualified before a disruption occurs. It also provides leverage in supplier negotiations, improves lead time flexibility, and supports continuous improvement through competitive benchmarking.

Regulatory Expectations

In the medical device industry, regulatory compliance is not optional, it is a core requirement. Agencies such as the U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), and other global regulatory bodies expect manufacturers to implement robust quality systems and risk management practices. While the FDA does not explicitly require multi-sourcing, it does mandate that manufacturers establish and maintain procedures to ensure that purchased products and services conform to specified requirements. This is outlined in 21 CFR Part 820.50, which governs Purchasing Controls under the FDA’s Quality System Regulation (QSR).

Multi-sourcing can play a critical role in meeting these expectations. By documenting supplier qualification processes, risk assessments, and contingency plans, manufacturers can demonstrate that they have taken proactive steps to mitigate supply chain risks. These activities should be captured in the Design History File (DHF), the Device Master Record (DMR), and the risk management file. When properly documented, multi-sourcing becomes a powerful tool for regulatory alignment, helping to satisfy auditors and inspectors while reinforcing the organization’s commitment to quality and patient safety.

Moreover, regulatory trends are increasingly emphasizing supply chain transparency and resilience. Initiatives such as the FDA’s Case for Quality and the EU’s Medical Device Regulation (MDR) highlight the importance of supplier oversight and risk-based decision-making. In this context, multi-sourcing is not just a tactical choice. It is a strategic enabler of compliance and long-term success.

Component Classification and Risk Assessment

Not every component in a medical electronics device requires a multi-sourcing strategy. Applying a risk-based approach to component classification helps engineering and procurement teams focus their efforts where they matter most. This method involves evaluating each component based on its impact on device performance, patient safety, and supply chain vulnerability.

Components can be grouped into three categories:

- Critical Components: These directly affect patient safety or core device functionality. Examples include sensors, microcontrollers, and power management ICs. A failure or delay in sourcing these parts can halt production or compromise device reliability.

- High-Risk Components: These may not be safety-critical but are difficult to source due to long lead times, limited suppliers, or frequent obsolescence. Examples include specialized connectors, custom ASICs, or niche passive components.

- Standard Components: These are widely available and typically have multiple suppliers. Examples include resistors, capacitors, and generic connectors.

Focusing multi-sourcing efforts on critical and high-risk components ensures that resources are allocated efficiently. It also aligns with regulatory expectations for risk mitigation and supports business continuity planning.

Altium’s advanced component management tools streamline this classification process. Using Altium teams can:

- Access up-to-date supply chain data, including lead times, lifecycle status, and availability.

- Tag components with custom risk profiles and sourcing categories.

- Integrate with supplier databases to identify alternate parts and cross-references.

- Use BOM intelligence to flag single-source dependencies early in the design phase.

This visibility allows engineers to make informed decisions and collaborate with procurement to proactively address sourcing risks.

Supplier Qualification and Documentation

Identifying alternate suppliers is only the beginning. To qualify a supplier, organizations must go beyond basic vendor selection and conduct a thorough evaluation of technical, operational, and quality capabilities. This process ensures that alternate sources are not just available, but reliable, compliant, and capable of meeting the product’s requirements.

Key steps in supplier qualification include:

- Verifying Technical Equivalence: Alternate components must meet the same electrical, mechanical, and environmental specifications. This may involve lab testing, datasheet comparison, and simulation.

- Conducting Supplier Audits or Assessments: On-site or remote audits help evaluate the supplier’s quality systems, manufacturing processes, and regulatory compliance. This is especially important for critical components.

- Documenting Supplier Capabilities and Certifications: Certifications such as ISO 13485, ISO 9001, and RoHS compliance should be verified and recorded. Supplier capabilities should be documented in Supplier Quality Agreements (SQAs).

All qualification activities should be referenced in the Purchasing Controls section of the Quality Management System (QMS). This ensures traceability and supports regulatory audits.

Altium provides powerful tools to support supplier qualification and documentation:

- Altium’s BOM management allows teams to track supplier data, including certifications, compliance status, and historical performance.

- Component lifecycle insights help identify parts at risk of obsolescence and suggest verified alternates.

- Design history ensures that sourcing decisions and supplier qualifications are documented and accessible for audits.

- Collaboration features enable engineering and procurement teams to work together in real time, reducing delays and improving accuracy.

By embedding supplier data directly into the design environment, Altium helps organizations maintain compliance, reduce risk, and accelerate time to market.

Design for Multi-Sourcing

Engineering teams play a pivotal role in enabling multi-sourcing by embedding flexibility directly into the design process. This proactive approach, often referred to as Design for Sourcing, ensures that alternate components can be integrated without major redesigns or delays.

Key tactics include:

- Selecting Components with Multiple Manufacturers: Choosing parts that conform to industry standards - such as JEDEC-standard packages - allows for broader sourcing options. These components are often available from several vendors, reducing dependency on any single supplier.

- Avoiding Proprietary or Single-Source Parts: Unless there is a compelling technical or regulatory reason, proprietary components should be avoided. These parts often come with long lead times, limited availability, and higher costs.

- Designing PCBs with Footprint Compatibility: Engineers should create PCB layouts that support alternate components with similar electrical characteristics but different physical packages. This might involve using dual footprints or pad geometries that accommodate multiple part numbers.

These strategies not only support multi-sourcing but also reduce the risk of redesigns when a component becomes unavailable or obsolete.

BOM Management and Change Control

A well-managed Bill of Materials (BOM) is essential for supporting multi-sourcing. It should not only list the primary components but also include approved alternates and cross-references to ensure flexibility during procurement and manufacturing. This structure allows purchasing teams to respond quickly to supply disruptions without waiting for engineering re-approval.

Key practices include:

- Including Alternate Parts in the BOM: Approved alternates should be listed alongside primary components, with clear documentation of equivalence and qualification status.

- Using Engineering Change Orders (ECOs): Any addition or modification of alternate sources should be documented through formal ECOs. This ensures traceability, supports regulatory audits, and maintains alignment between engineering and procurement.

- Maintaining Version Control and Audit Trails: BOM changes should be tracked over time, with clear records of who approved what and when. This is especially important in regulated environments like medical device manufacturing.

Altium’s BOM management and change control tools are designed to support multi-sourcing workflows:

- BOM management allows teams to manage primary and alternate components in a centralized, cloud-based environment.

- Integrated ECO workflow ensures that changes to the BOM are documented, reviewed, and approved within the design platform.

- Version history and audit logs provide full traceability for compliance with FDA and ISO standards.

These capabilities help organizations maintain a dynamic, compliant BOM that supports sourcing flexibility without compromising quality or traceability.

Communication Between Engineering and Procurement

Successful multi-sourcing depends on strong collaboration between engineering and procurement teams. These groups must work together throughout the product lifecycle, from initial design to production ramp-up, to ensure that sourcing decisions are informed, practical, and aligned with business goals.

Best practices include:

- Regular Design Reviews with Sourcing Input: Engineering reviews should include procurement feedback on supplier availability, lead times, and cost trends. This helps engineers make informed choices about component selection and layout.

- Shared Access to Supplier Data: Procurement teams should have visibility into the design environment, while engineers should be able to access supplier performance metrics and sourcing constraints.

- Joint Risk Assessments: Both teams should participate in evaluating the risks associated with single-source components and identifying mitigation strategies.

Altium fosters cross-functional collaboration through its cloud-based platform.

- Collaboration tools allow engineering and procurement to share designs, BOMs, and sourcing data in real time.

- Commenting and review features enable asynchronous feedback and decision-making across teams and time zones.

- Supply chain analytics provide procurement with actionable insights into part availability, pricing trends, and supplier reliability directly within the design workflow.

By bridging the gap between design and sourcing, Altium helps organizations build more resilient products and more agile supply chains.

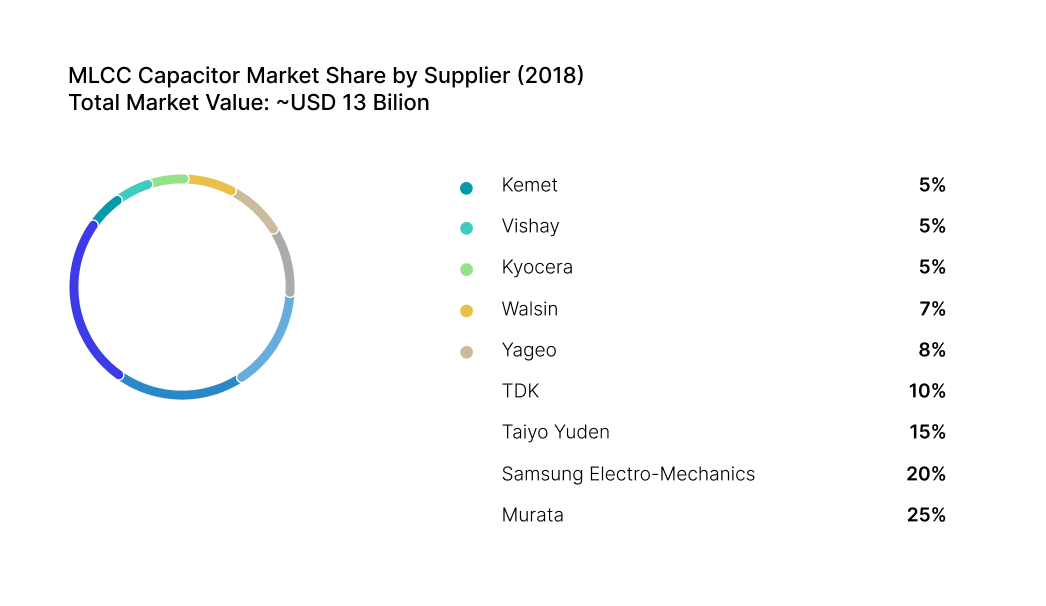

Case Study: 2018 Capacitor Shortage Response

In 2018, the electronics industry faced a severe shortage of multilayer ceramic capacitors (MLCCs), driven by skyrocketing demand from smartphones, automotive electronics, and IoT devices. Lead times stretched beyond 50 weeks 1, and manufacturers scrambled to secure inventory. While many companies were caught off guard, a few stood out for their resilience, thanks to proactive multi-sourcing strategies.

One such company had implemented a structured multi-sourcing framework years earlier. Their engineering and procurement teams had jointly classified MLCCs as high-risk components due to their limited supplier base and long lead times. As a result, they had pre-qualified multiple suppliers for key capacitor types, including alternate vendors with compatible specifications and certifications.

When the shortage hit, this foresight paid off. While competitors halted production or redesigned boards to accommodate available parts, this company maintained output with minimal disruption. Their BOMs already included approved alternates, and their PLM system tracked supplier performance and compliance. Engineering Change Orders (ECOs) were used to document substitutions, ensuring full traceability and regulatory alignment.

This case highlights the real-world value of multi-sourcing, not just as a theoretical best practice, but as a critical enabler of operational continuity. It also underscores the importance of continuous market monitoring and supplier diversification, especially for components with volatile supply dynamics. Learn more in the following resources:

- MLCC Shortages by Case Size: 2018

- Global MLCC Shortage Continues, Drives Demand for Alternative Technologies

Conclusion

The 2018 MLCC capacitor shortage served as a wake-up call for the electronics industry, especially in regulated sectors like medical devices. Companies that had invested in structured multi-sourcing strategy, classifying components by risk, qualifying alternate suppliers, and embedding sourcing flexibility into their designs, were able to maintain production while others faced costly delays and redesigns. This real-world example underscores the importance of proactive planning, cross-functional collaboration, and continuous market monitoring.

Avoiding common pitfalls, such as assuming equivalence without testing or neglecting documentation, requires a disciplined approach. Structured processes, supported by digital platforms and clear communication between teams, are essential to sustaining supply chain resilience.

In today’s volatile market environment, multi-sourcing is no longer optional. It is a strategic necessity for ensuring continuity, protecting product timelines, and safeguarding patient outcomes. By embedding these principles into design and procurement practices, organizations can future proof their supply chains and stay ahead of the next disruption.