Building Resilient Supply Chains: Strategic Component Portfolio Management

Risk management in the PCB industry is no different from any other field. It’s a structured journey, which begins with identifying potential risks, then measuring them with the right metrics. From there, teams define the actions needed to reduce exposure. And for lasting resilience, they commit to the most important step of all: continuously monitoring and evolving their strategy.

Industry-Specific Pressures

The overall formula remains consistent across sectors, but each industry faces its own unique pressures. In aerospace, the challenge lies in managing the sheer breadth of risk within highly regulated production. In automotive, the focus is on navigating rapid digitalization and the electrification of products and infrastructure. For PCB manufacturers, who serve as upstream stakeholders in both industries, the priority is ensuring that products keep pace with evolving technological demands, particularly the need for greater computing power to support artificial intelligence.

Supply Chain Due Diligence on the Rise

Every industry manages risk in its own way, but a common trend is a growing emphasis on supply chain due diligence. Companies increasingly depend on more profound insight into product availability, alternatives, lead times, and the risk of obsolescence.

With global instability driving supply chain shifts, operational risks across industries are on the rise. Labor shortages and resource scarcities have caused repeated disruptions this decade, placing supply risk at the forefront and forcing procurement teams to ask:

- What changes are coming?

- Which supply chains are capable of delivering?

- How do we quantitatively measure and score the resilience of our critical suppliers?

- Beyond immediate disruptions, what are our suppliers' long-term exposures to environmental and regulatory risks?

- How can we future-proof our key supply chains against geopolitical shifts and the reconfiguration of global trade routes?

Key KPIs to Quantify Portfolio Resilience

To build resilience, PCB procurement teams must go beyond identifying risks. They need up-to-date, actionable metrics to determine the value of their efforts. Key data points include component lifecycle and obsolescence indicators, lead-time stability, and recovery time following disruptions. Modern tools designed to address these challenges make this possible.

The Octopart BOM Tool, for example, automatically analyzes each component in a BOM for lifecycle health, flagging parts that are Not Recommended for New Designs (NRND), End-of-Life (EOL), or already obsolete. Seeing potential problems early helps teams spot risky components before they cause delays in production, which can save money on redesigns or urgent sourcing efforts.

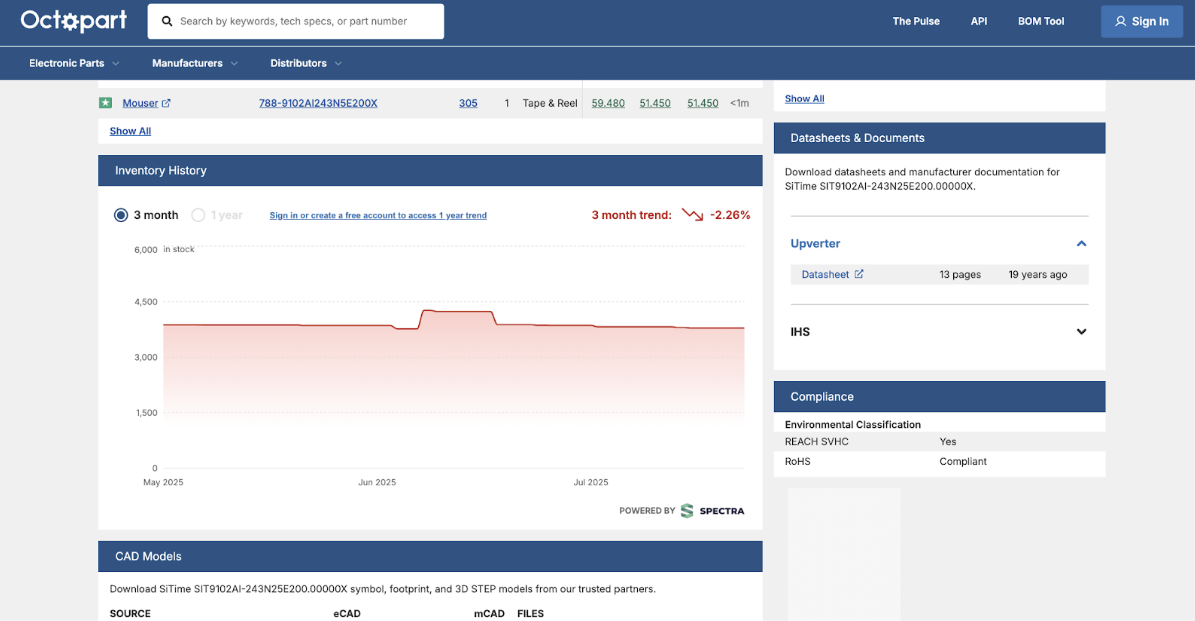

Octopart also provides historical inventory data, allowing teams to assess supply volatility and make smarter purchasing decisions. You can plan your inventory more strategically, striking the right balance between carrying costs and the risk of shortages to keep the supply chain stable without overspending and eroding profit margins.

Supplier Diversification for Long-Term Stability

Another critical part of strategic component portfolio management is supplier diversification. Relying too heavily on a single vendor or geographic region increases exposure to disruptions, price volatility, and capacity constraints.

Octopart helps mitigate these risks by making it easy to compare offers across hundreds of global distributors and thousands of component manufacturers, revealing multiple sourcing paths for each component. With clear visibility into regional availability, lead times, and by utilizing distributor profiles, procurement teams can proactively reduce their reliance on single sources, assess the long-term viability of their partners, and prioritize relationships that enhance both performance and continuity.

Stay Ahead with Octopart

Tools like Octopart help manage component inventories by bringing the latest up-to-date component data directly into purchasing processes. Integrating the latest insights ensures BOMs reflect current supply conditions, steering obsolete or unavailable parts from the production line. As a result, procurement can adapt swiftly to supply chain disruptions.

Back

Back