The Impact of Supply Chain Disruptions on BOM Management

Global supply chain disruptions have fundamentally reshaped how electronics teams manage bills of materials (BOMs). Tariffs, freight inflation, and shifting trade patterns in 2025 are forcing engineers and sourcing teams to build strategies around what’s available, not what’s ideal. As a result, BOM supply chain management has become a strategic capability rather than a downstream procurement task.

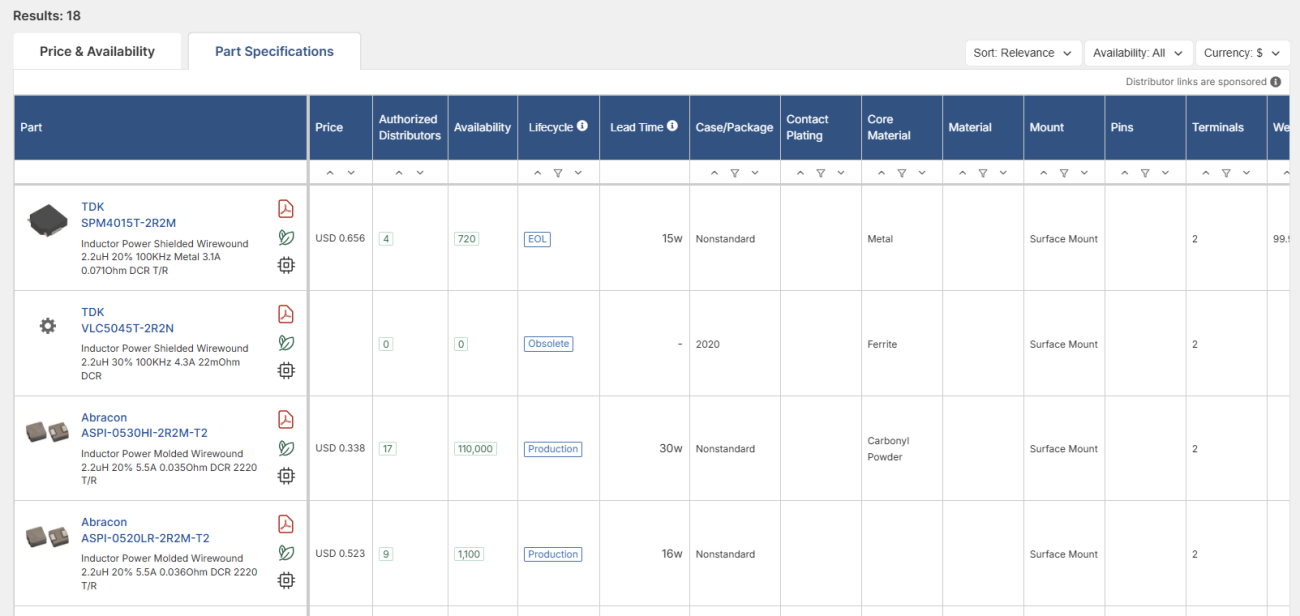

In the supply chain, a Bill of Materials (BOM) defines the components, quantities, and sourcing dependencies required to manufacture a product. Understanding the BOM meaning in the supply chain is critical, because every line item introduces potential risk related to availability, lifecycle status, cost volatility, and supplier concentration. These pressures make adaptive BOM management and up-to-date sourcing insight a core advantage. The Octopart BOM Tool equips teams with the latest data, supplier alternates, and flexible sourcing options to respond quickly when conditions change.

What Is BOM in Supply Chain Management?

A BOM in supply chain management serves as the connective tissue between engineering intent and procurement reality. While traditionally viewed as a static engineering document, the modern supply chain BOM functions as a living dataset that directly impacts production timelines, costs, and risk exposure.

In today’s environment, BOM supply chain management determines whether teams can adapt to shortages, qualify alternates, and maintain continuity when disruptions occur. Without real-time visibility into availability and lifecycle status, even well-designed products can stall before reaching production.

Persistent Supply Chain Pressures

The electronics supply chain faces not only inconsistent capacity, but sustained high-volume demand. Global production across the electronics and IT industries is forecasted to grow 8% in 2025, driven by AI applications, data center expansion, and vehicle electrification. The imbalance between accelerating demand and fluctuating production capacity is the root cause of the ongoing volatility.

Meanwhile, Lead Time Report for Q2 2025 confirms stubbornly long lead times across key component categories. Passive components continue to average roughly 34 weeks, discrete devices around 26 weeks, and embedded systems (including MCUs) also near 26 weeks. In this environment, design cycles are increasingly chained to component realities rather than engineering schedules.

To prevent delays, BOM supply chain strategies must prioritize designing for availability, qualifying alternates, and managing procurement expectations with real-world supply conditions. Treating the BOM as a static artifact exposes teams to unnecessary schedule risk.

Rising Costs and Lead Time Volatility

For manufacturers, component scarcity directly translates into financial and operational risks. The IPC's May 2025 sentiment survey reported that 65% of electronics manufacturers were experiencing rising material costs, underscoring the direct margin impact of supply instability.

Lead time volatility further compounds the margin threat. Even though lead times might become more stable overall, important areas related to AI infrastructure, like memory and high-cap MLCCs, are facing increasing shortages and price changes. Even modest lead-time swings can force costly expedites, redesigns, or missed revenue targets.

It’s not a minor procurement inconvenience. It’s a measurable business risk. An electric vehicle startup recently struggled with a 12-week lead time for critical battery management systems (BMS) ICs, joepardizing $20 million in delayed launches and more than 35% of projected quarterly sales.

Lifecycle visibility, alternate qualification, and diversified sourcing at the BOM level are now mission-critical to defend against escalating delay costs and margin erosion.

The Rise of the Risk-Intelligent BOM

The Bill of Materials (BOM) has fundamentally shifted from a static engineering blueprint to a dynamic data hub powering predictive sourcing. Modern BOM supply chain management treats the BOM as a "mission control dashboard," enabling engineers to design for availability by embedding multi-source paths and alternate parts from the outset.

Risk-intelligent BOMs incorporate:

- Multi-source paths and approved alternates

- Lifecycle and obsolescence awareness

- Supplier concentration and regional risk visibility

Automated digital solutions are now essential for supply chain resilience. Beyond basic inventory tracking, global tensions and regional dependencies demand deeper visibility into a component's origin to ensure long-term future stability.

Demand driven by technology like AI is simultaneously creating severe supply constraints in both the highest-end processors (DDR4, DDR5, HBM) and the seemingly simple supporting parts like specialized passive components. The result is a dual vulnerability where a production schedule can be equally halted by a shortage of a complex semiconductor or a low-cost commodity component, making every category a potential single point of failure.

To handle this risk, teams need to work together closely, keep track of changes continuously, and update their purchasing data with detailed and up-to-date supply data to match what’s happening in the market.

How Octopart’s BOM Tool Improves Sourcing Agility

The Octopart BOM Tool delivers the actionable insights and current market visibility required to manage BOM disruptions at scale. The system flags lifecycle risks, obsolescence, and inventory shifts before they escalate into production blockers.

By aggregating inventory across authorized and non-authorized distributors, Octopart reduces single-source dependency and enables faster alternate qualification. Engineers and sourcing managers can compare suppliers, assign backups, and adjust project plans in just a few clicks—without restarting the design process.

By embedding lifecycle intelligence and alternate sourcing directly into BOM workflows, teams reduce redesign cycles, protect margins, and maintain production momentum even as supply conditions fluctuate.

Why Adaptable BOM Supply Chain Management Matters Now

As global supply chains remain unpredictable, the ability to adapt has become a defining competitive advantage. BOM management in the supply chain is no longer reactive, it is a strategic lever that determines resilience, speed to market, and long-term profitability.

Modern BOM supply chain management enables organizations to:

- Anticipate shortages before they impact schedules

- Reduce dependency on constrained or single-source components

- Align engineering decisions with the latest availability data

- Respond faster to disruption without sacrificing design intent

Conclusion

Electronics manufacturers are navigating a supply chain shaped by sustained demand, constrained capacity, and growing complexity. BOM disruptions are no longer isolated events, they are a persistent condition of modern product development.

Organizations that continue to treat BOMs as static documentation will remain vulnerable to delays, cost overruns, and reactive redesigns. Those that embrace adaptable, data-driven BOM supply chain management are better positioned to maintain continuity and respond decisively to global disruption.

The future belongs to teams that turn uncertainty into informed action.