Designing Resilient Medical Electronics Through Multi‑Sourcing

For medical-electronics teams, multi-sourcing is a design and compliance requirement that underwrites continuity of care. Since 2020, cascading shocks have exposed fragility in components, foundry capacity, logistics corridors, and cross-border trade. Executive surveys show nine in ten supply leaders still encountered disruptions in 2024. Many boards still lack a structured view of supply risk. At the same time, companies are pivoting toward regionalization and dual-sourcing to balance resilience with cost.

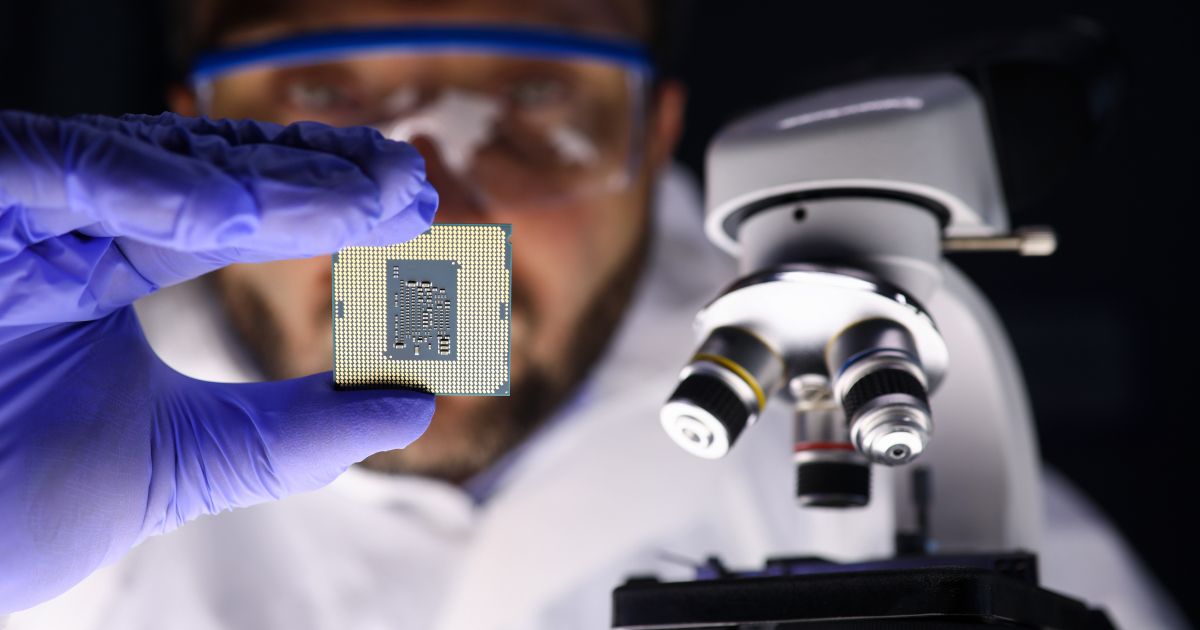

In MedTech, the bar is higher. In fact, the U.S. FDA has formalized shortage-reporting expectations and created an Office of Supply Chain Resilience, while industry bodies call out semiconductors and medical-grade materials as priority risks. Semiconductors are a special case: capital is shifting capacity to new geographies through the CHIPS-like policies worldwide, but export controls and tariff volatility complicate sourcing math in the near term.

This article outlines five practical multi-sourcing strategies for medical electronics, detailing the inputs, unique elements, required actions, and the resilience benefits each provides, helping engineering, supply chain, and quality stay aligned.

Key Takeaways

- Multi‑sourcing is a compliance‑driven requirement in MedTech, reinforced by FDA’s shortage‑reporting expectations and the creation of the Office of Supply Chain Resilience, making resilience part of design, not just procurement.

- Dual‑sourcing, cross‑grade alternates, and design‑for‑alternates provide component‑level continuity, addressing semiconductor volatility, export controls, tariff swings, and medical‑grade material risks without full product re‑architecture.

- Regionalized EMS networks and tariff‑aware routing provide system‑level resilience, reducing exposure to geopolitical trade shifts, logistics instability, and country‑of‑origin dependencies while maintaining regulatory traceability and sterilization/UDI requirements.

- Med‑electronics teams must integrate supply‑chain risk into engineering artifacts, using ALVs, parametric BOMs, EMC delta testing, and variant management to keep essential performance consistent across alternates and maintain audit‑ready documentation.

Strategy 1 - Dual-Sourcing Critical Components (Same Spec, Two Qualified Suppliers)

What it is: Split demand for a part (e.g., PMIC, MCU, sensor, power inductor) across two qualified sources with sufficient inventory or capacity.

Inputs to this strategy: Procurement needs a list of the main value-creating components so that they can identify multiple sources accordingly. Ideally, designers perform this task ahead of time so that buyers can focus on supplier identification.

What’s unique about this approach: Dual-sourcing is the fastest path to resilience at the component level because you can implement it within a year, without re-architecting the product or factory footprint. Logistics providers note it’s a rapid buffer against tariff volatility and port disruptions, provided you also tune trade-compliance and PO-level visibility to handle dual origins. In MedTech, dual-sourcing intersects with quality systems (ISO 13485/21 CFR 820), sterilization routing, and UDI/traceability. It therefore requires stronger configuration management and incoming inspection plans than in general electronics.

Output actions:

- Split annual volumes and safety stock targets.

- Qualify both suppliers in terms of inventory, capacity, quality, and traceability.

- Define demand-shifting rules for tariff step-ups, embargo notices, fabrication incidents, etc.

Strategy 2 - Cross-Grade Alternates (Functional Equivalents)

What it is: Pair a primary value-creating device with a pin-compatible or near-compatible alternate from a different silicon family and vendor (e.g., ARM® MCU families, op-amp lineages, ADCs with matching interface/accuracy, etc.), accepting that firmware or PCB layout may require minor variants.

Inputs to this strategy: Because export controls and industrial policies are reshaping chip availability and geography, cross-grade alternates hedge both foundry concentration and policy shocks.

What’s unique about this approach: Designers pre-engineer alternates in anticipation that their preferred value-creating part will not be available at some point during major production runs, and it recognizes that identical alternates do not always exist.

Output actions:

- Run upfront EMC delta testing for both options (IEC 60601-1-2).

- Pre-qualify programming/test fixtures for each variant.

- Identify additional vendors to support variants as needed.

For medical electronics, keep labelling and 510(k)/technical file notes that show how essential performance remains unaffected across alternates. On the sourcing side, codify tariff-aware routing (e.g., “if origin X exceeds duty Y, switch to origin Z”) in your procurement SOPs, aligning with Deloitte’s guidance on balancing performance and cost under reconfigured trade routes.

In Altium, you can use:

- Component Templates to lock electrical/thermal parameters

- Alternative Part Choices to keep symbol/footprint common while swapping supplier PNs

- Variants to manage firmware or passive value tweaks needed by the alternate

With managed releases, you preserve a chain of custody for each variant’s Gerbers file and assembly outputs, making regulatory re-use easier.

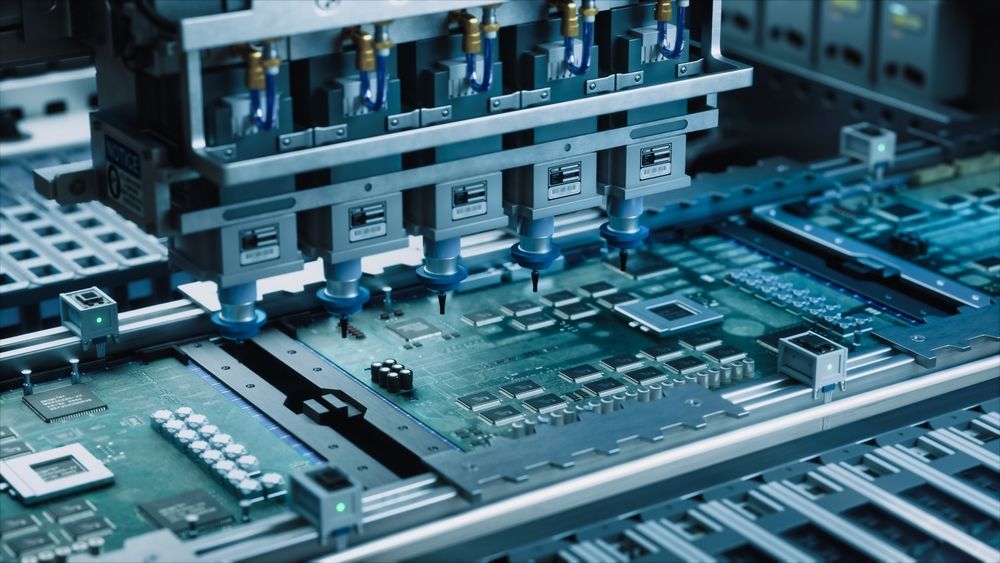

Strategy 3 - Regionalized EMS/ODM and “Make-Where-You-Sell” Nodes

What it is: Qualify two or more regionally distributed contract manufacturers for the same product (e.g., North America + ASEAN/EU), including mirrored testing, on-the-line firmware flashing, quality control, and serialization processes.

Inputs to this strategy: Sales data by region; tariff/duty exposure by country of origin; logistics constraints; and a transfer plan that enforces quality control across plants.

What’s unique about this approach: It’s a network strategy rather than a part strategy. It addresses macro risks tariffs, export controls, Red Sea route instability, port strikes by reducing cross-border traversals and enabling duty-optimized builds. BCG emphasizes building multiple regional networks and pooling investments with contract manufacturers to reach the “cost of resilience” frontier. That logic is powerful for MedTech’s variable-demand portfolios.

Output actions:

- Mirror test and inspection stations

- Golden PCB assemblies for test correlation

- Systems for Electronic Device History Record (eDHR) and Electronic Document Management System (eDMS) data capture at each EMS

- Qualify alternate sterilization partners and packaging materials that meet regional regulations (where applicable)

- Add regionalized work instructions to Device Master Records (DMRs)

In Altium, users can push controlled releases to multiple EMS partners with region-specific fabrication and assembly outputs. Supplier links and BOM checks help EMS purchasing teams see viable alternates without diverging from your AVL.

Strategy 4 - Design-For-Alternates in the PCB

What it is: Engineer footprints, keep-outs, passives, and the BOM so that a family of drop-in alternates can be placed without re-spinning the board. If not all direct replacements are possible, then design with the minimum number of possible variants.

Inputs to this strategy: List of the major value-creating components with suitable package-compatible alternates.

What’s unique about this approach: Instead of reacting to a shortage by changing the PCB layout, you bake in options that your EMS can execute under ECO control. This is especially valuable in categories where package availability swings (non-generic ASICs).

Output actions: Depending on the particular components being addressed, multiple BOMs or multiple variants are created to address inventory changes. Multiple rounds of qualification at the component level may be needed, so planning ahead becomes a major factor in consolidating test efforts. For memory and logic, add test-point coverage to speed first-article checks when alternates are loaded. Finally, consider a parametric BOM that lists acceptable ranges for key parameters so engineering can quickly qualify possible alternates on-the-fly without violating approved clinical performance.

Strategy 5 - Tariff-Aware and Export-Aware Routing

What it is: Source and route parts and subassemblies to minimize tariff exposure and assure regulatory continuity, especially when governments alter export controls or shortage-reporting rules.

Inputs to this strategy: Product HS codes; rules-of-origin (e.g., USMCA/RCEP) for assemblies; entity and denied-party screening; and a regulatory watchlist for FDA shortages and Section 506J guidance. Note that the FDA has finalized guidance to expand shortage notifications and is pressing for stronger early-warning mechanisms.

What’s unique about this approach: It treats trade compliance as a design input. By designing sourcing routes and final-assembly locations with origin rules in mind, you preserve market access and margin. This is especially important in MedTech, where price pass-through is constrained by reimbursement. Industry commentary and consulting guidance point MedTech toward building command centres and dynamic routing to handle tariff volatility.

Output actions: An AVL and shipping routes that account for tariff costs and export control restrictions by region. The AVL information can be included in the BOM in the usual way so that procurement can manage orders and consignment of parts.

In Altium, trade parameters (HS code, COO, ECCN) can be entered into medical electronics designs as parameters in components. Region-specific output jobs can also be configured so you can build compliant label sets and documentation per region. With sharing controls, users can provide the latest trade-annotated BOM upon request.

How the Six Strategies Work Together

Design for alternates and dual-sourcing secure component continuity. Regionalized EMS and tariff-aware routing secure network continuity. Designing for alternates secures technology continuity when nodes or export regimes shift. The combination aligns with the broader pattern consultants and trade bodies describe as “regionalization plus redundancy,” which is guided by data. For semiconductors, the path is realistic: resilience is improving through geographic diversification.

|

Strategy |

Inputs |

What’s unique in med-electronics |

Output actions |

Resilience element |

|---|---|---|---|---|

|

Dual-sourcing critical parts |

BOM risk ranks; lifecycle; quality plans |

Fastest to implement; fits QMS with tighter incoming control |

AVL pair, split rules, PPAP-like qual, auto shift triggers |

Redundancy & responsiveness |

|

Cross-grade alternates |

HAL, timing/EMC budgets; obsolescence |

Hedges wafer node/controls; minor firmware deltas |

Dual footprints/APIs, EMC delta tests, tariff-aware SOP |

Adaptability & diversity |

|

Regionalized EMS |

Demand heatmaps; duty exposure; sterilization |

Addresses macro tariffs/logistics; duty-optimized builds |

Mirrored test/keys, identical DMRs, command centre |

Geographic optionality |

|

Parametric design-for-alternates |

Package maps; DFM; EMC/thermal |

Removes need for respins; handles package swings |

Dual-pattern footprints, no-stuff pads, parametric BOM |

Structural flexibility |

|

Risk-scored AVL governance |

COO, wafer/assembly sites; lanes |

“Risk as design input”; aligns w/ shortage vigilance |

Taxonomy, scoring thresholds, scenario playbooks |

Visibility & anticipation |

|

Tariff/export/shortage-aware routing |

HS/ECCN; origin rules; 506J list |

Treats compliance as design input; preserves pricing |

Trade-annotated BOMs, dual routes, 506J drill |

Compliance-driven continuity |

Conclusion

Multi-sourcing in medical electronics is a design strategy, a network strategy, and a compliance strategy, not just a buying tactic. The six strategies above provide a practical blueprint to cut dependency risk at the part, product, and plant levels while staying audit-ready and margin-sensible. Evidence from previous years shows that companies that regionalize production, adopt dual-sourcing, and instrument their risk processes are the ones turning resilience into advantage. With Altium as your digital backbone for components, alternates, BOM health, and controlled releases, you can turn that blueprint into repeatable practice so the next supply shock becomes a managed switch, not a missed surgery.