Electronics Supply Chain Sentiment Indicates a Gloomy 18 Months

Consumer sentiment seems to be telegraphing itself onto engineer sentiment (or vice versa) based on new survey results from Avnet. According to a new survey from Avnet Insights, which includes 530 engineers from various geographical regions surveyed online from Nov. 4 to Dec. 3, engineers expect the supply chain environment to get worse before it gets better. These results are the first of such a survey conducted by Phoenix-based Avnet, the world’s largest distributor of electronic components with $20 billion in annual revenue. Survey respondents were chosen from Avnet’s global customer database.

The main result from the Avnet survey is as follows: a startling 96% of all survey respondents expressed concerns that product lead times will get longer and prices will go higher over the next 18 months. This is in spite of a record projected $190 billion in new semiconductor CAPEX in 2022, of which over one-third is being spent by Intel and TSMC ($69 billion between both companies). It’s a staggering amount of new spending, and it comes on the back of a 36% increase in industry-wide CAPEX that occurred in 2021.

Of all the news stories I’ve looked at recently, those that continue to stand out are those pulling sentiment up and down faster than component stocks. Yes, this particular news story reveals a dreary outlook on an already dreary electronics supply chain situation. However, it’s possible there is a silver lining here for the industry writ large.

Low Sentiment Has a Silver Lining

The massive new CAPEX spending being announced by the major semiconductor manufacturers would normally be tempered by fears of an economic slowdown. In particular, given higher than normal inflation and geopolitical challenges, there are real fears of economic slowdown in the US and Europe. Given the highly cyclical nature of the semiconductor industry, the new CAPEX will likely lead to a semiconductor surplus over the next 24-36 months, barring any COVID resurgence or protracted geopolitical challenges.

Until the new semiconductor manufacturing capacity comes online, we have to look at how engineers are projecting the supply-demand imbalance to affect their sourcing decisions. Based on the results from the Avnet survey, it seems that engineers are expecting growth in electronics development to continue increasing, thus tilting the supply-demand imbalance even further. Therein lies the silver lining: survey respondents are overwhelmingly expecting greater growth in electronics development over the next 18 months.

Projected growth in the industry is still expected to remain well above global economic GDP growth projections (approximately 5% CAGR); it appears the expectations of surveyed engineers is in line with this idea of greater growth driving mid-term supply-demand imbalance.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sources:

*ResearchAndMarkets.com

**ReportLinker.com

***360MarketUpdates.com

****IMARC Group

These same growth expectations, and the 18-month sourcing expectations of engineers, are reflected in two key business indicators of greatest concern to the industry: material and labor costs. According to February 2022 survey data published by IPC, these two metrics, as well as orders and shipments, are expected to increase over the next 6 months. Meanwhile, inventories (available from vendors and to customers) are expected to decrease or stay flat by a wide majority. These data are summarized below.

The results reveal strong growth, which drives demand for more chips and raw materials, coupled with inflating labor and materials costs. The thesis we can develop from survey results and growth projections is strong growth will continue to outpace supply in the near term, but these pressures may ease in the long term to ensure sustained industry growth beyond an 18 month time frame.

Despite Growth, Sourcing Pains Persist

Looking out 18 months into the future is nice, and I think the long-term prospects for every segment of the industry are encouraging. If you’re just starting your career as an electronics engineer, and you’re getting into the electronics industry, the future is bright. If you’re an entrepreneur who plans to build a new hardware startup, it’s probably never been a better time to enter the industry and build your new product.

However, we still have to source components today. Personally, I’ve had to sit and watch as semiconductors in some designs suddenly run totally out of stock while waiting for stakeholders to make critical engineering decisions. It costs everyone in terms of time, money, and stress.

So what are companies doing to try and deal with the near-term shortages? Some of these buying decisions include:

- Allowing inventories and prices drive design decisions

- Considering alternative chipsets (e.g., FPGAs instead of MCUs + ASICs)

- Buying critical components immediately once they are designated “must-have”

- Turning to overseas brokers in greater numbers

- Double ordering components

- Entering into trades with distributors or brokers

- Keeping less in-stock inventory

At the end of the day, we all operate based on the data we have available. If chips remain out of stock, and the sourcing situation has continuously gotten worse, we shouldn’t be so surprised that engineers would expect existing supply chain challenges to continue getting worse. However, with a bit of supply chain and inventory visibility, it’s possible to identify parts that can help you ensure somewhat sustained production over the long term.

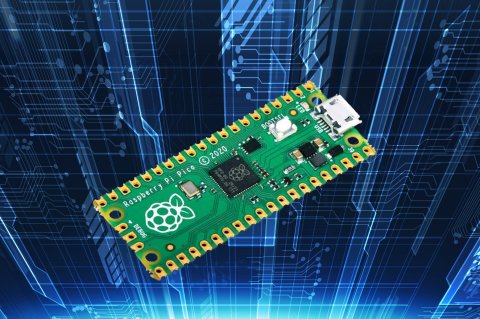

At Altium, our goal is to give every engineer the tools they need to manage their parts orders and inventories with the complete set of supply chain tools in Altium Designer®. Designers that want to take greater control over their supply chain can use the Altium 365™ platform to work securely and reach unprecedented levels of efficiency.

We have only scratched the surface of what is possible to do with Altium Designer on Altium 365. Start your free trial of Altium Designer + Altium 365 today.